Solución pionera para la optimización de la rentabilidad de los créditos y clientes. ARM está basado en el Aprendizaje Automático, predice el impago en la admisión del riesgo y en los activos de crédito. ARM sugiere y automatiza acciones para la elusión de impagos y la minimización del impacto en el negocio.

ARM permite recopilar información cuantitativa y cualitativa, ajustar los modelos predictivos en tiempo real, obtener resultados y publicar esos resultados hacia los sistemas operacionales actuales de la compañía y sus usuarios cuando estos los necesiten.

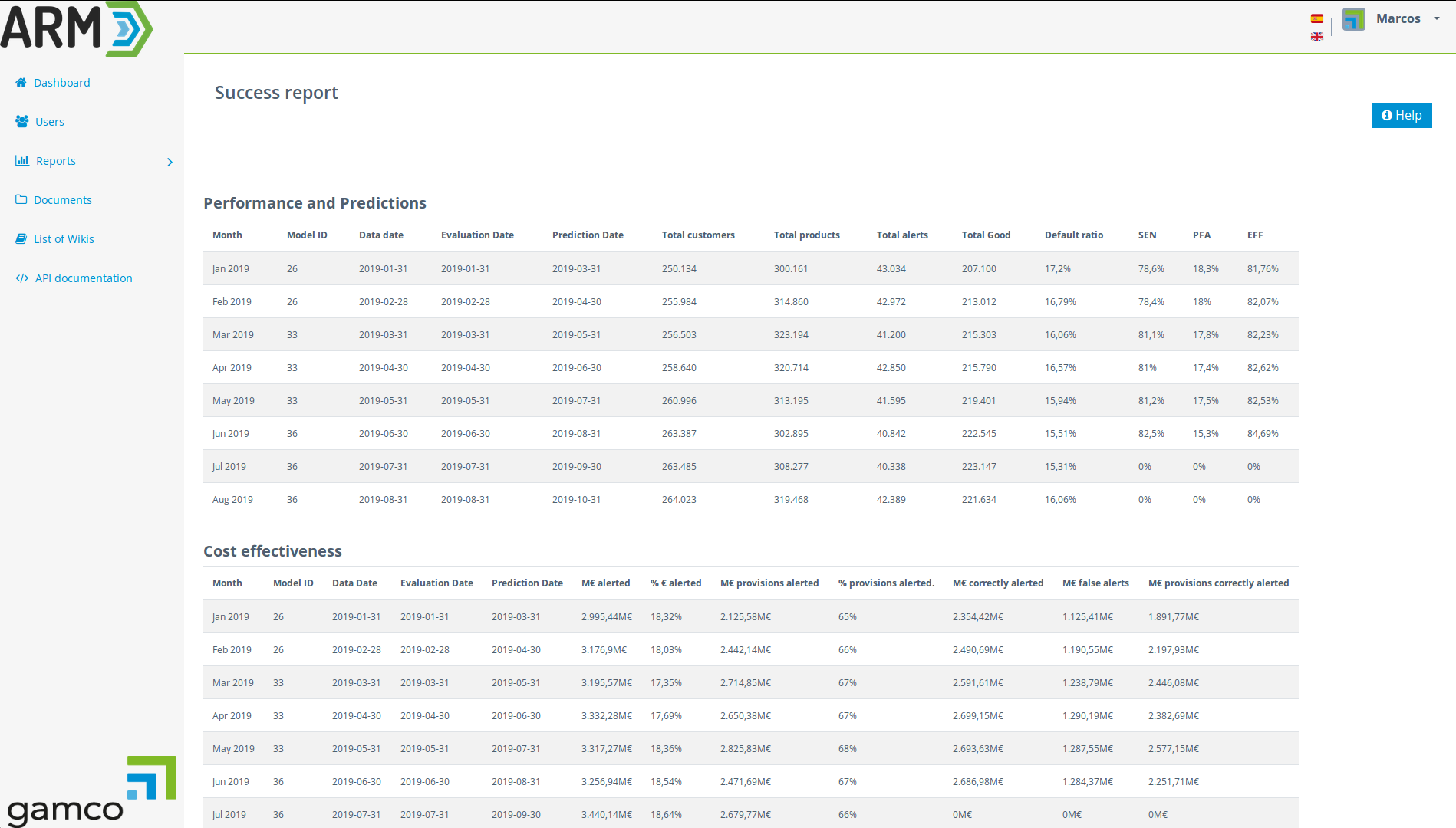

Cálculo del éxito

Seguimiento del éxito en las predicciones de impagos y “default” en admisión gracias a nuestra solución AOS (Assessment of Operations Success). AOS también permite medir el impacto en el negocio, pudiendo calcular los KPIs más ajustados a cada unidad de negocio o necesidades concretas de cada entidad.

Ayuda

Visualización de datos

En el mundo del Big Data, las herramientas y tecnologías de visualización de datos son esenciales para analizar cantidades masivas de información y tomar decisiones basadas en los datos.

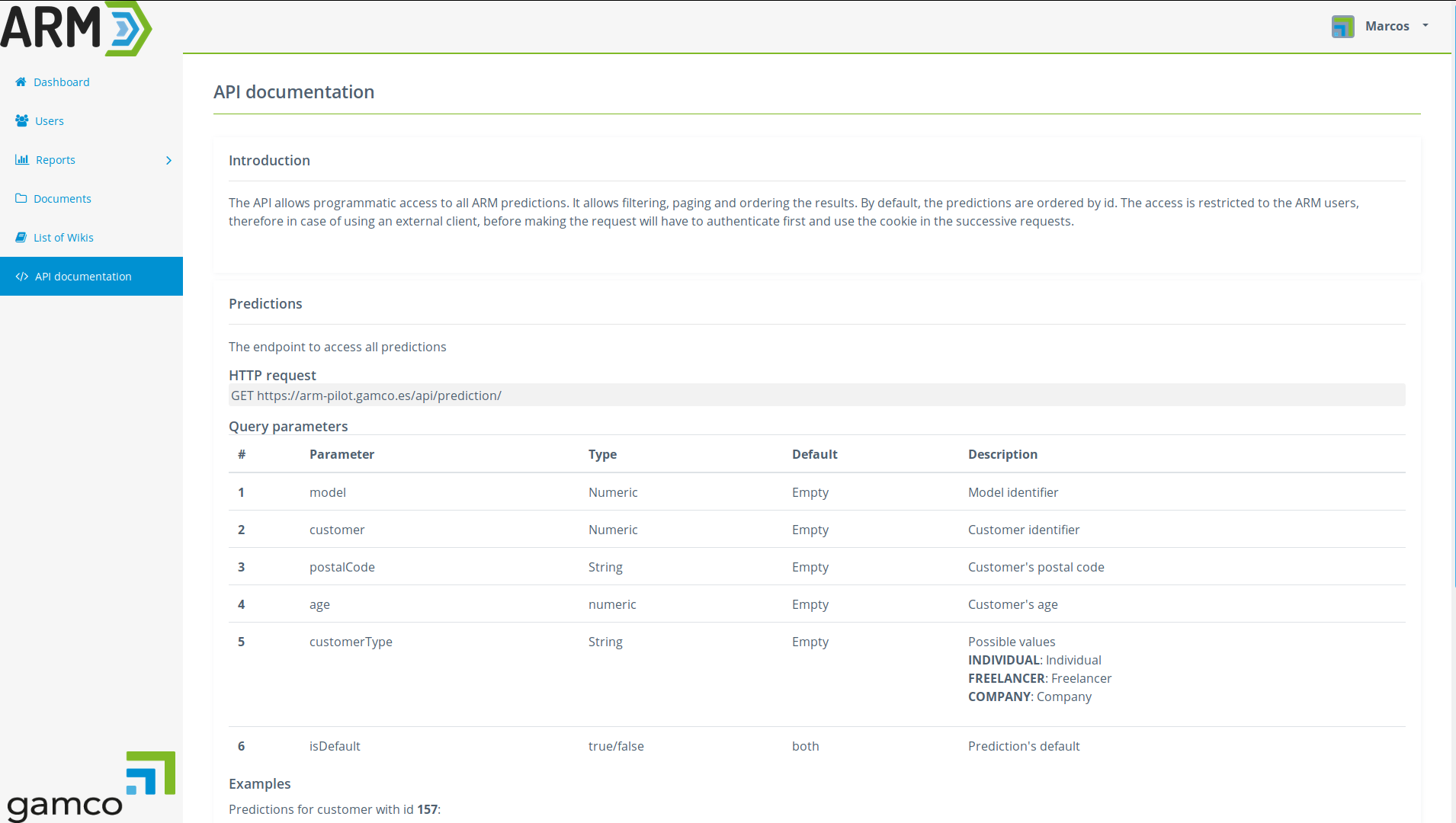

Servicios API

- Independencia de tecnologías / lenguajes

- Fiabilidad, escalabilidad, flexibilidad

- Experiencia de usuario. Respuesta de datos planos legibles por un usuario

Bibliotecas de programación para clientes del API

Proporciamos el código de programación necesario para comenzar a usar el API Esto es lo que hace una biblioteca de programación cliente. Ayuda a reducir la cantidad de código que los desarrolladores de aplicaciones tienen que escribir y garantiza que estén utilizando la API de la mejor manera admitida. Ver demo de cliente del API.